Free help: USER GUIDE

Home > Clients & Profits X User Guide > Accounting > Adding Job Cost Invoices

|

Clients & Profits X Online User Guide |

Vendor invoices are added into Accounts Payable as they are received

Adding the invoices is a relatively easy process, since you’ll be entering information right from the invoice. An invoice can have one or many invoice line items. Each line item is a separate job cost, and contains a job number, task, net amount, and gross amount. Invoice line items can also account for overhead expenses, such as office supplies, but don’t get a job number. An invoice can contain any combination of billable job costs and unbillable expenses.

If you write purchase orders, A/P invoices can reconcile your commitments automatically as they’re added. When you enter the invoice’s PO number and line number, details from the purchase order -- vendor, terms, job, task, and amount -- are copied to the invoice. The line number is important, since it matches up the right PO line item with the vendor’s invoice. This saves time, plus makes your job costing more accurate. Also, you’ll see at a glance if the vendor is billing you for more than you authorized on the purchase order. Insertion orders are handled like purchase orders.

If you don't know which PO line item to use, delete the line number then press tab. The Lookup PO Lines window opens, listing the amounts from the purchase order. You'll see the job number, task, description, and cost amount for each line item. Double-clicking on a line item copies it onto the A/P invoice automatically.

|

|

|

|

|

Learn

about adding and managing your client information

in

this Clients & Profits classroom video training

session. Running time: 4:53 |

|

|

|

To add a job cost invoice

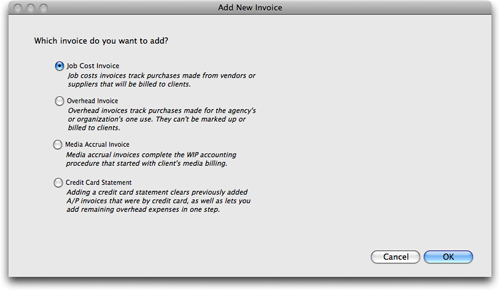

1 From the Accounts Payable window, click on the Add button. You will be prompted to choose which invoice you wish to add.

To bypass this option, simply choose Edit > Add New Invoice > Job Cost Invoice.

The Add Job Cost Invoice window opens.

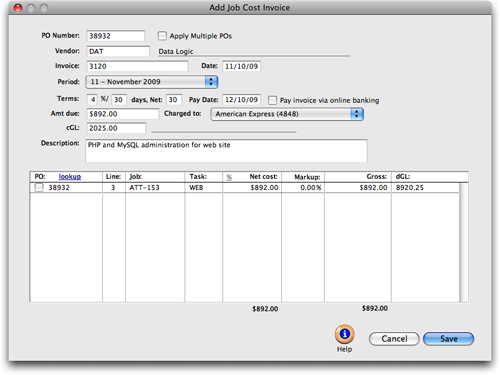

2 Enter the job cost invoice's details:

PO Number Entering a purchase order number here will automatically copy in the purchase order's vendor and total amount due. Each line item from the purchase order will be copied into the distribution section of the job cost invoice. If you do not want to include a line item from the purchase order, then simply uncheck the box for that distribution line. The total dollar amount will be recalculated for you.

If the A/P invoice does not have a purchase order, then leave this field blank.

If the A/P invoice is for both job cost and overhead expenses or is for more than one purchase order, then leave this field blank. Purchase order numbers can be entered later in the distribution section. Job "NONE" can be used for overhead expense items. What if a vendor’s invoice doesn’t have a number? You’ll need to make one up that includes the vendor number and some kind of number, such as today’s date (e.g., ABC063094). The cGL should always be an A/P liability account. If not, your subsidiary ledger will not equal your balance sheet.

Vendor number Every invoice needs a vendor number, which links the invoice with the vendor account.

Invoice number Every payable needs an invoice number. This number identifies the invoice everywhere -- cost reports, journal entries, and vendor account agings. For this reason, invoice numbers must be unique. The same number can’t be used twice for the same vendor; if so, you’ll get a warning message.

Invoice Date/Accounting Period The invoice date should be entered from the invoice itself. It is the date the vendor issued the invoice, not the date it was received. This date is important since it’s used to calculate the age of your unpaid payables on aging reports. The invoice can be posted into any unlocked accounting period. The period determines which month will be updated when the invoice is posted. The current accounting period (from Preferences > Accounting Periods) is entered automatically, but can be changed by choosing a period from the pop-up menu. If the period is locked, you’ll get a warning message.

Payment terms/date The invoice’s payment terms indicate when and how the invoice should be paid, including what discounts -- if any -- can be taken if paid early. Payment terms have three parts: the discount percentage, the early payment period in days, and the net number of days until the invoice is due. Percentage is the discount percentage available to you if the invoice is paid early. Enter it as a whole number (e.g., 2) and not as a fraction (e.g., .20). Days shows when, in days, an invoice must be paid to earn the discount. Net is the number of days the vendor allows to pay the invoice, before it becomes overdue. Payment terms are copied from the vendor account, but they can be customized on the invoice. Changing the terms on the invoice doesn’t change the vendor account. The pay date is the date you plan to pay this invoice. A pay date doesn't affect the General Ledger, so it is not required, however it does serve a useful purpose. The pay date is used to calculate the days until due counter that can be viewed when the invoice is displayed in the Accounts Payable window. Cash Flow reports use the pay date to show unpaid invoices based on a range of pay dates. And, in the Checkbook, checks can be automatically written for A/P invoices selected through a pay date.

Pay invoice via online banking When you add an A/P invoice and select "Pay invoice via online banking," you are designating that invoice to be paid by an online payment in your checkbook. To pay the invoice, choose accounting > checkbook, then select "Online payment". Enter the vendor and the exact amount of the invoice you are paying via online banking. The invoices for that vendor that are marked for online payment that have that amount will appear in the drop-down list, allowing you to choose the one you are paying.

Note: you can only pay one invoice at a time using the online payment. When you post the online payment it posts to the G/L like a normal check so no Journal Entry is needed because the check makes the Journal Entry. The Online payments have their own set of check numbers. To set up the Online number range, choose Setup > Chart of Accounts. Double click on the checking account and enter the starting number in the "Next Online Pmt #:" field.

Note: Once you designate an AP to be paid via online banking you can only pay it with an Online payment. Also, unpaid AP's marked for online payment will not appear on the Vendor Aging unless you choose the option"Show invoices to be paid with online payments.

Invoice amount and credit G/L amount This is the amount due to the vendor for this invoice, including shipping, sales tax, and any additional charges. This is the amount you’ll pay the vendor, and not the amount you’ll bill your clients. The invoice amount updates the vendor balance. The amount is credited to the A/P account in the General Ledger. The credit G/L account (i.e., cGL) is a liability account, and would be one of your Accounts Payable accounts. It is copied from the vendor file, but can be changed on the invoice.

Invoice description The description explains what was purchased. It appears everywhere the invoice appears, including job cost reports and G/L journal entries. It’s customizable, so you can enter anything that helps document the invoice.

3 Enter the job cost invoice's distribution:

If you entered a purchase order number in the po number field above, then the cost distribution was automatically copied in for you based on the purchase orders line items.

PO Number/Line Number A purchase order is not necessary to add a job cost invoice. If there is no purchase order, then simply tab past the PO and Line fields. To add a purchase order, enter the po number here. If you don't know the po's number, you can click on the Lookup link to view all open purchase orders for the vendor. Double click on a po number to select it. Once you tab past the po number field, a "1" will automatically copy into the line field. Any line number can be added here, or to view the po's line items, delete the "1" and tab. The Lookup Order Lines window will open. Double click on a line item to select it.

Job/Task The client number isn’t added directly onto job costs; instead, the client is copied from the job number. That’s why the job and task are essential for accurate cost accounting. If you entered a PO number, the job and task are entered automatically from the purchase order; if not, you need to enter it. Tabbing past the job number verifies that the job number exists; if isn’t correct, the job Lookup List opens listing open jobs. Information from the job task, such as the markup and billable status, will be copied automatically to the invoice.

If this distribution amount is for an overhead expense, type in "NONE" for the job number.

Net Amount The net amount (aka commissionable net amount) is the amount of the invoice that will be marked up. It’s the amount before sales tax, shipping, and other amounts on which you don’t charge commissions. For example: if the vendor includes sales tax on the invoice, enter its commissionable net as the invoice amount without the tax -- the gross amount will be calculated as the invoice’s full cost amount plus the commission amount. The commission amount is the commisionable net times the markup percentage.

A percentage of the job cost invoice's total amount can be added for this distribution by clicking on the percentage link.

Markup Percentage The markup is copied from the vendor account first, then the job task (if it has one will override the vendor markup). The typical agency markup is 17.65%, which earns a 15% commission. It is user-defined, so you can use any markup. Changing it here doesn’t change the markup percentage in the vendor account or the job task.

Enter the markup as a number (e.g., 17.65) and not a fraction (.1765).

If the markup was copied from the purchase order, it isn’t replaced by the vendor’s markup. Instead, the vendor’s markup is only used when the PO doesn’t have a markup. In any case, you can enter your own markup on this invoice -- without affecting the markup on the PO, vendor, or job.

Billable Amount The billable amount is the amount that the client will later be charged, including markups, fees, and commissions. It is calculated automatically from the commissionable net and the markup percentage. The billable amount can be changed to a higher (or lower) amount, as needed. To make this invoice unbillable, delete the billable amount and enter a 0.00 instead. The invoice’s cost amount will update the job task, but there will be no amount to bill the client.

Debit G/L Number The debit G/L (i.e., dGL) is a job cost account. It is copied from the job task. Job costs are booked by default as costs, not unbilled inventory, when they are posted. This may be different from other systems you’ve used. Clients & Profits accounts for costs by period, so this invoice’s costs can appear in the same period as the client billing.

Charged To A/P invoices can be charged to a credit card by selecting one from the "Charged to" pop-up menu. By doing this, you can later clear A/P invoices paid by a credit card and add remaining charges in one step in the Add Credit Card Statement window. Adding a credit card statement has all the benefits of adding a job cost A/P invoice, where job costs & overhead charges can be added on one invoice. However, it has an additional benefit: it can pay any A/P invoice with an outstanding balance.

4 Click Save.

Once the invoice is saved, it can be proofed, changed, or deleted anytime before it is posted. The invoice doesn’t update vendors, jobs, or the General Ledger until posting. Posting creates journal entries and increases the vendor’s balance. Unposted invoices don’t appear on job, cost, or accounting reports.